How Can I Prevent Estate Disputes Among Siblings in Michigan?

Children are the most rewarding part of many people’s lives. Several people dream of having multiple children, to whom they can pass on their life experience, wisdom, and family legacy. Many people also wish to pass on their assets to their children. This may include sentimental items such as personal keepsakes and heirlooms, investments such as property and businesses, or valuables, including money and jewelry. In most cases, siblings will happily share their parents’ inheritance and amicably split assets among themselves. However, this may not always be the case.

Multiple factors may contribute to creating estate disputes among siblings. This can be something as powerful as long-lasting sibling rivalry to simple disagreements over how certain assets should be split. Sometimes, certain siblings may feel they have more right to dictate how assets should be divided. This is especially true for eldest siblings or siblings who have spent more time and effort caring for aging family members. This is why, if you have multiple children, it’s vital to consult an experienced attorney to prevent estate disputes. A skilled attorney can help you preemptively tailor your estate plan to ensure your children are taken care of with minimal to no conflict between them over their inheritance.

What is Estate Planning in Michigan?

Estate planning is the process of establishing what you want to happen to your earthly possessions after you are gone. Most people know about wills. However, wills may be only one component of a comprehensive estate plan. This is because wills can be very specific about what a person wishes to happen to their earthly remains. They also tend to deal with funeral arrangements. While a will may stipulate who receives particular possessions and assets, items not explicitly named in a will may enter probate. This is the legal process of determining who inherits particular property after a person dies.

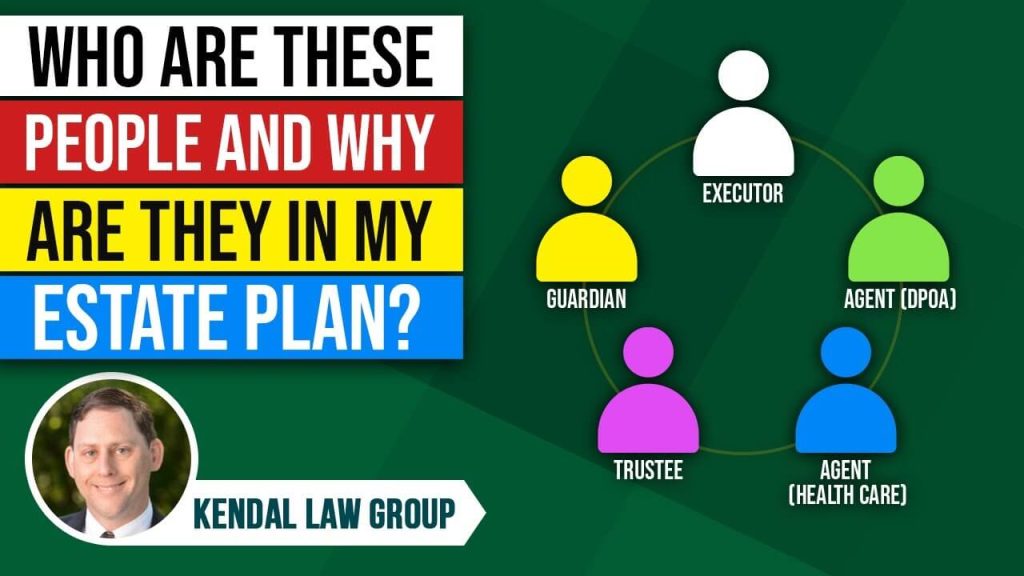

A comprehensive estate plan will cover all potentialities related to a person’s estate. This includes but is not necessarily limited to medical decisions to be made in the event the person is incapable of making them, who will receive vehicles, property, and valuables, what will happen to any minor children in the deceased’s custody, and more. Estate planning is an intensive process that aims to provide as much financial security and peace of mind as possible to the person doing the planning. It is also meant to eliminate guesswork, legal battles, and stress for the person’s heirs.

How Can I Avoid Estate Disputes Between My Children in Michigan?

If a comprehensive estate plan isn’t drawn up, it can lead to arguments and disputes among siblings. This is why it is vital to consider multiple factors when estate planning. Some strategies for eliminating estate disputes between siblings include but are not necessarily limited to:

- Comprehensive Wills

- Trusts

- Gifts

- Ladybird Deeds

- Mediators

- Third-Party Executors

A comprehensive will is one strategy for eliminating disputes. A comprehensive will names specific items going to specific individuals. It can also specify that any items not named in the will go to a precise individual.

Trusts are another effective tool. When someone sets up a trust, they become known as a guarantor. The guarantor transfers ownership of certain assets to another individual for safekeeping, the trustee. When the guarantor passes away, there is no ambiguity about the ownership of the assets in the trust because they legally belong to the trustee. The trustee will then follow the wishes of the guarantor when distributing these assets.

Individuals may also circumvent sibling disputes by gifting specific property while they are still alive. Some assets, such as jewelry or sentimental items, can be gifted. Other assets, such as cash, may not necessarily transfer so quickly. This is because of gift taxes. In 2024, an individual could gift another person up to $18,000 without having to pay taxes. This is why consulting an estate attorney is vital if you are considering estate planning.

Ladybird Deeds are another effective strategy. These are deeds stipulating that specific property will automatically become the legal property of another named individual or individuals in the event of the original owner’s death. This way, ownership automatically transfers upon death.

If you are uncertain how certain assets should be divided, appointing a mediator can be valuable. A mediator is a neutral third party assigned to help make legal negotiations. A mediator can work with your children and their attorneys to negotiate who will receive what property and assets.

Establishing a third-party executor is another crucial step to consider. You may be tempted to name a family member as the executor of your will. However, they may not be unbiased. They could take sides with one sibling over another or attempt to negotiate assets for themselves. A neutral, third-party executor with no vested interest in your estate can be a valuable way to reduce or eliminate sibling disputes.

These are only a few potential options. This is why, if you are concerned about potential estate disputes among siblings, you must consult an experienced attorney.

What Should I Do if I’m Concerned About Potential Estate Disputes Between Siblings in Michigan?

Emotions tend to run high after a parent passes away. This can lead to potential discord between your children. An argument over inheritance after death can lead to irreversible conflict between siblings. This means a parent’s death could mean the end of a lifelong sibling relationship. That is why if you are estate planning in Michigan, it’s vital you contact the attorneys of Kendal Law Group PC, located at 4190 Telegraph Rd, Suite 3000, Bloomfield Hills, MI 48302.

The attorneys of Kendal Law Group PC understand the importance of family. They also know how emotionally intense the death of a parent can be and how this can lead to sibling disputes. They know these disputes can lead to long-lasting hurt feelings and animosities that permanently damage families. This is why they work hard with every client to ensure estate plans are as airtight and comprehensive as possible. Kendal Law Group PC’s estate plans will help to reduce and eliminate any potential sibling disputes and ensure your children remain close and united through difficult times.

Everyone wants to leave their families with happy memories. No one wants their legacy to be broken relationships and arguments between family members. If you or a loved one is planning an estate and want to reduce or eliminate the potential for sibling disputes, call Kendal Law Group PC today at 248-609-1718 or email them for a free consultation. They help keep families together through the most difficult times.

Kendal Law Group PC

Kendal Law Group PC 248-609-1718

248-609-1718

aaron@kendal-law.com

aaron@kendal-law.com